To be successful in a crowded marketplace, it is important to understand the competitive advantages of your company’s solution against its alternatives. Enterprises must be well-versed in their competitors’ product strategies, offerings, and features. A fruitful method for gathering this intel is competitive product analysis—an evaluation of your competitors' products to determine their strengths, weaknesses, and current position in the market.

There are several aspects to consider when evaluating competitors’ products. Let this blog be your guide as to who can utilize this intel to their advantage, where you should focus your efforts, and how you can best maximize your results.

NEED COMPETITIVE INTELLIGENCE BEST PRACTICES? USE OUR FREE TOOL >>

Competitive product analysis stakeholders

You may be surprised by the variety of functions at your company that can benefit from product-related competitive intel—these include marketing, sales, customer success, and more. In fact, our 2021 State of Competitive Intelligence Report detailed that stakeholders’ perspectives on competitive intelligence (CI) are shifting entirely. 92% percent of CI stakeholders say CI is important to overall success, whereas this figure was 85% last year.

A competitive product analysis allows a wide range of stakeholders to make better-informed decisions in their roles and develop a clearer vision of where the company stands in the broader market landscape.

Product

The data pulled from a competitive product analysis can be a critical resource for product teams. This insight can help pinpoint product gaps, spark new ideas, and drive further innovations of a product. Product teams must continuously explore their competitors’ shortcomings, allowing them to stay one step ahead while improving their product’s capabilities.

Sales

Sales teams have to be well-informed on all competitors’ products in order to best position their own to prospective customers. Chances are, a prospect is talking to multiple companies, comparing each one. Imagine—a prospect says, “I noticed that your competitor has a new feature that will help streamline this process. Do you have that feature as well?”. If you’re unfamiliar with that feature and can’t point out what differentiates your product, you may lose their business. Coming into prospective meetings with a strong understanding of the nuances of competitors’ products can have a significant impact during sales discussions.

Marketing

To be a successful marketer, it is important to understand how your company stacks up in its competitive marketplace and how it connects with target audiences. Marketers need to gain insight into rivals’ products, honing in on messaging, positioning, and recurring trends. Marketers can utilize the insight from a product competitive analysis to develop stronger language, marketing strategies, and campaigns highlighting their solutions’ competitive advantages.

Customer success

For customer success teams, intel gathered from a competitive product analysis allows them to improve overall product satisfaction and customer retention. For example, say an at-risk customer mentions that they’re looking at another company. Having your point of contact well-prepared to strategically respond can make or break whether they stay onboard. Keeping them in the loop on all competitors’ product updates, changes, and innovations is critical to successful dialogue with customers and retention rates.

Leadership

Executive teams are always looking for ways to make their company more successful and profitable. While leadership is always in tune with the market landscape, they don’t always know the ins and outs of competitors’ products. Providing executives with a robust report of compiled insight can help them better determine the company’s next steps as they define and execute their long-term vision.

7 tips for analyzing your competitor’s product

Now that we’ve established who can benefit from a competitive product analysis, let’s explore how to conduct one.

1. Go deep on the website

A great starting point is to scope out your competitor’s website. In a sense, it’s a cheat sheet right at your fingertips—full of product details that you can pull into your analysis. While a homepage, for example, can reveal a lot about a competitor’s priorities, diving deep into your rival’s product page is most important as it’s filled with actionable intel.

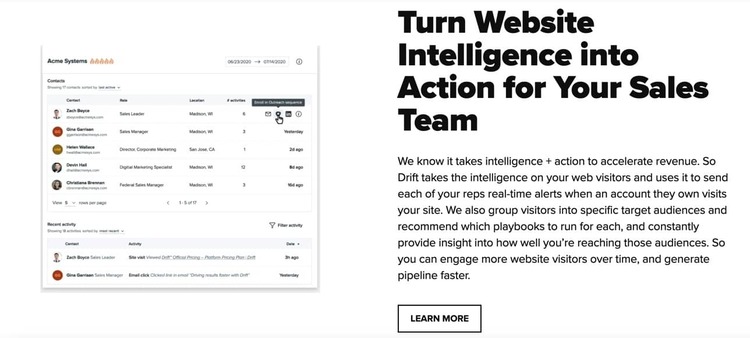

Let’s explore a section of Drift’s product page as an example:

From a glance, it’s clear that the company turns “website intelligence into action” for sales teams. But, what’s also important is the text underneath the heading. Did you notice that it mentions sending reps “real-time alerts” and grouping “visitors into specific target audiences”? Taking that extra step and pulling out those smaller details can prove to be worthwhile for your analysis.

In fact, product pages are most likely the most robust resource you will come across during your analysis. Take note of the basic functionalities of your competitors’ offerings as well as the messaging and use cases. Bringing it a step further, analyze documentation, help sites, and other niche website pages to answer questions that aren’t readily available on a competitor’s product page.

2. Focus on the flagship product

Next, pinpoint your competitor’s flagship product—their ‘bread and butter.’ As markets evolve and competition heats up, companies are continuously expanding their product line and offerings. Focus on your competitor’s core solution. Chances are, it’s your rival’s first product ever launched and has the highest sales over time. Also, due to its longevity in the market, it likely has built out robust functionality for critical customer use cases.

When analyzing this main product offering, examine its key functionalities and benefits. You’ll likely gain an understanding of why your competitor was founded and what made it successful.

3. Benchmark your own products

Something often overlooked when conducting a competitive product analysis is evaluating your own products. To understand the scope of your competitor’s capabilities, you need something to compare it to, right? Compare and contrast and determine what differentiates the product from your own. Not only will you better understand your product’s strengths and weaknesses through benchmarking, but it’ll help you identify what specific criteria to dig into further.

4. Watch videos

If a picture is worth a thousand words, then a video is worth a million. The goal of many product videos is to break down the key functionalities and benefits into simple terms. It likely expands upon the points you’ve already located on the website—and in this case, the more detail the better! They also tend to reveal the user experience, something you wouldn’t be able to find elsewhere.

To locate these clips, check YouTube, Vimeo, and the company’s website. These videos can bring your attention to potential issues as well as spark ideas on how to improve your own product and features.

5. Gather feedback from customers

All enterprises want to position themselves as best-in-class—but is that really the case? The greatest way to tell is by directly connecting with a competitor’s customer or a current customer that ended its relationship with a rival. This first-hand feedback can tell you a great deal about how the solution and company are doing. Ask questions like: What made you choose XYZ over our company? Is there anything that you feel our solution is lacking in comparison to XYZ? Are there any pros and cons that stick out to you about our solution? You may be surprised by how much actionable intel you can pull from this one interaction.

This is a great opportunity to conduct a win/loss analysis—the process of determining why deals are won or lost. After speaking with them, you’d be able to share with your team the exact reasons that the company went in a different direction while having a better overall grasp of your competitive landscape.

However, while interviewing them is a great way to gain intel, we understand that’s not always a plausible scenario. A common alternative is to explore review sites and forums to reveal customer feedback. Reviewing feedback through online channels will give you an inside look into recurring problems and areas of development. Keep your eye on questions about functionality, forum threads on workarounds, and pros and cons listed by customers in reviews.

6. Keep an eye on marketing

When diving into the solution, remember to take a holistic approach and focus on the product’s overall marketing strategy. Take note of the messaging used for the product’s benefits and primary use cases as it will be revealing in how the enterprise aims to drive the demand and usage of the product. Some specific things to focus on include category names, product taglines, positioning pillars, proof points—the list goes on and on!

In fact, understanding how a competitor presents its solution to the market can allow you to better articulate and differentiate your own product’s functionalities and benefits. For example, if a competitor states that their product is the "best in New England,” you can take it one step further in your messaging and say "the proven global leader." Keeping watch on your competitors’ marketing strategies can keep you from falling into dull and outdated product language.

7. Track changes to identify product direction

Identifying changes to your rival’s products and investments can foreshadow where the enterprise is headed. Don’t just focus on your competitor’s product today—determine its direction. Ask yourself—when was the last time they made updates to the product? Have they hired a new product development manager? Look for signs that significant product improvements are at play as these changes can help you piece together the company’s strategy. Note any product launches, new department hires, small fixes, or recent improvements.

Make competitive product analysis a habit

There’s no question that analyzing your competitors’ products is quite the undertaking. To beat out competitors as they improve their products, you must routinely conduct a competitive product analysis. Be clear about your goals and desired outcomes, and remember that this is an ongoing process as new developments emerge.

Whether you are looking for intel on new product launches or trying to inspire ideas for your new product marketing campaign, this insight is not only valuable to your direct team but your entire company. Bring all stakeholders to the table to utilize this intel and have an in-depth conversation about how your product stacks up.

Just remember, staying competitive means staying in tune with your industry’s product market—keep this blog close as you dive into your competitive product analysis!

Seeing is believing! Check out Crayon for yourself.

Take a Product TourRelated Blog Posts

Popular Posts

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

24 Questions to Consider for Your Next SWOT Analysis

24 Questions to Consider for Your Next SWOT Analysis

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking