With over 400,000 new businesses opening in the United States each month, the need for individual companies to conduct their own market research has never been more urgent. However, conducting market research isn’t an easy task — it presents challenges to businesses of all shapes and sizes.

With that being said, those with large budgets do enjoy certain advantages. When you have access to an endless array of top-tier tools and resources, you can uncover strategy-changing insights with relative ease.

Does that mean businesses with small (or non-existent) budgets are out of luck? Absolutely not.

Nowadays, free market research tools and resources are abundant — and you’ll be familiar with eight of our favorites by the time you’re done reading this blog post.

Compete like you mean it. Get a demo of Crayon ↓

But first, some housekeeping:

What is market research?

Market research is the process of gathering and analyzing information about your customers — both current and prospective — with the intent of optimizing your business strategy.

Customer-related information that you may want to gather includes (but is not limited to):

- The goals they want to achieve

- The pain points they want to alleviate

- The income or budget that constrains them

- The products and/or services they use (a.k.a. your competitors)

- The strengths and weaknesses of the products and/or services they use

Why is market research important?

Market research is important because — if you’re thorough and open-minded — it dramatically improves your chances of long-term success. Only through market research can you uncover the insights you need to develop a product or service that (1) satisfies the demands of your prospects and (2) stands out from the competition.

For a complete overview of how conducting market research can benefit your business, here’s Market Research Defined and How to Get Started.

Cool? Cool. Let’s dive into the good stuff.

Top 4 Free Market Research Tools

For clarity, we will define a free market research tool as any tool that:

- Costs nothing, and

- Helps with the collection and/or analysis of customer-related information

Keep in mind that “customer-related information” encompasses everything from a pain point to a weakness of one of your competitors’ products.

1. Google Trends

If you want to get a sense of the level of interest in a particular product or service — as well as how that interest fluctuates over time and across regions — Google Trends is an excellent tool.

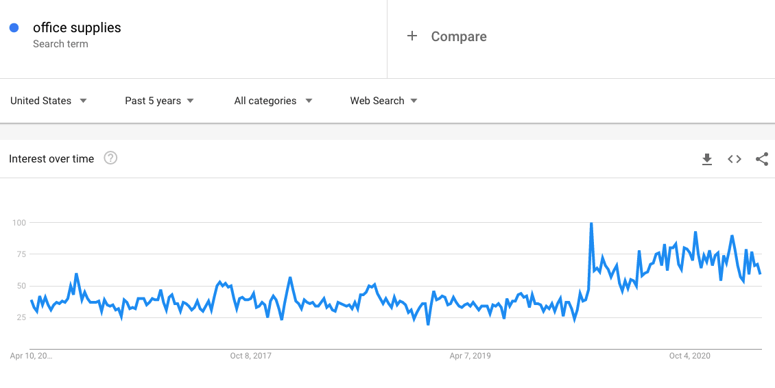

All you need to do is enter a search query and toggle with the filters. As an example, take a look at the level of interest in “office supplies'' in the U.S. over the past five years. Perhaps unsurprisingly, interest peaked in February 2020 — at the onset of the COVID-19 pandemic:

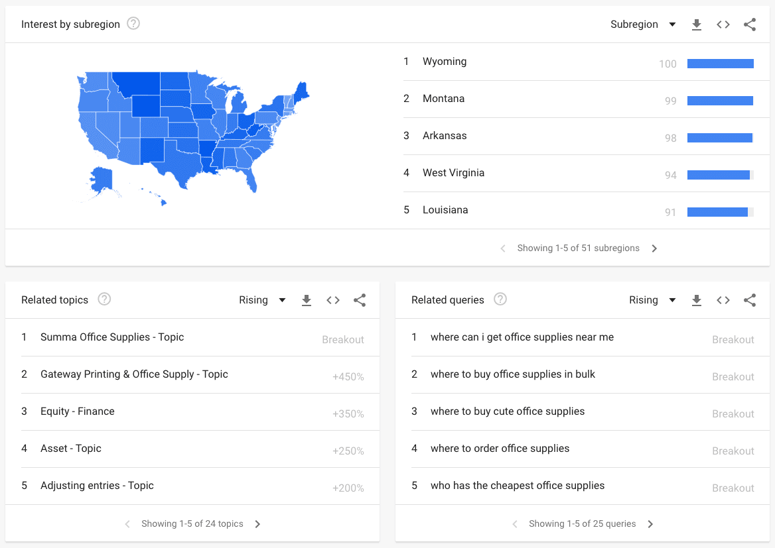

Plus, you can explore variations in interest across the 50 states, as well as related topics and queries that are surging in popularity:

The “interest by subregion” data is powerful. In Wyoming, searches for “office supplies” account for a greater percentage of all search queries than in any other state. Your average resident of Wyoming, in other words, is more interested in searching for office supplies than is your average resident of, say, Louisiana — a valuable insight for anyone who sells office supplies online.

Equally valuable is the insight that searches for “where to buy office supplies in bulk” are on the rise — potentially indicative of an emerging pain point.

2. SurveyMonkey

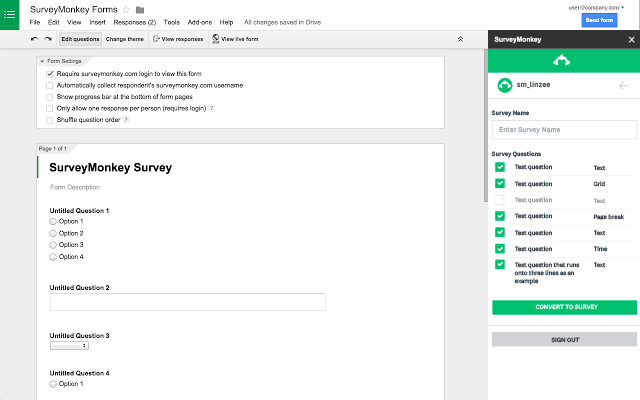

As some of you already know, one of the best ways to conduct market research is to ask your customers a handful of open-ended questions. You can do this for free with SurveyMonkey.

Specifically, with a free SurveyMonkey account, you can ask up to 10 questions and field up to 40 responses with each of your surveys.

Open-ended questions you may ask your customers include (but are not limited to):

- Why did you buy our product?

- What has our product helped you accomplish?

- How does our product compare to others that you’ve used in the past?

With just three questions — well under the limit of a free survey — you can learn quite a bit about your target market. If, for example, the majority of respondents say they bought your product because they were struggling to do their jobs in a cost-effective manner, that gives you a clearer picture of your prospects’ pain points and your competitors’ weaknesses.

3. Make My Persona

As you collect and analyze customer-related information, it’s a good idea to create or tweak your buyer personas: detailed profiles of the semi-fictional people for whom your product or service is designed. In the context of market research, personas are useful because they help you synthesize and comprehend the information you’re gathering.

Thanks to our friends at HubSpot, you can use a wonderful free tool called Make My Persona.

Intuitive and fun, Make My Persona is a seven-step process that walks you through the essential components of your target customer: demographic information, firmographic information, job title, pain points, and so on. And if you want to go beyond the bare essentials, you can add as many extra sections of information as you like.

Important note: Your personas should be dynamic. As you conduct further market research and learn more about your target customers, your personas should evolve accordingly.

4. WordSift

Make My Persona is appealing, in part, because it enables you to make sense of raw data — to separate the signal from the noise. The same can be said about WordSift, the final free tool we’ll be discussing today.

Built to help teachers with the instruction of vocabulary and reading comprehension, WordSift allows you to generate word clouds: images that represent the frequency with which certain words are used in a given body of text. Look what happens when I copy the introduction to this blog post and paste it into WordSift:

Instantaneously — and unsurprisingly — I can conclude that “business,” “market,” and “research” are among the most frequently used words in the introduction to this post.

What does this have to do with market research? Well, let’s say you’ve been using SurveyMonkey to ask your customers about their reasons for buying your product. One by one, if you were to copy their responses and paste them into WordSift, you’d be able to see which words your customers use most often. That’s a market research gold mine!

Top 4 Free Market Research Resources

Again, for clarity, we will define a free market research resource as any resource that:

- Costs nothing, and

- Helps with the collection of customer-related information

The scope of “customer-related information" remains the same — encompassing everything from a pain point to a weakness of one of your competitors’ products.

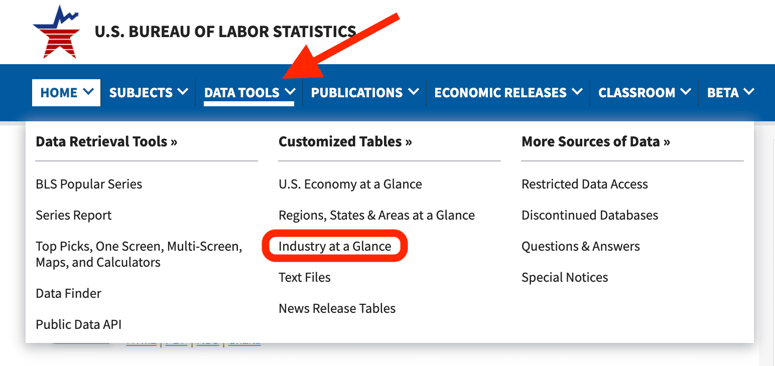

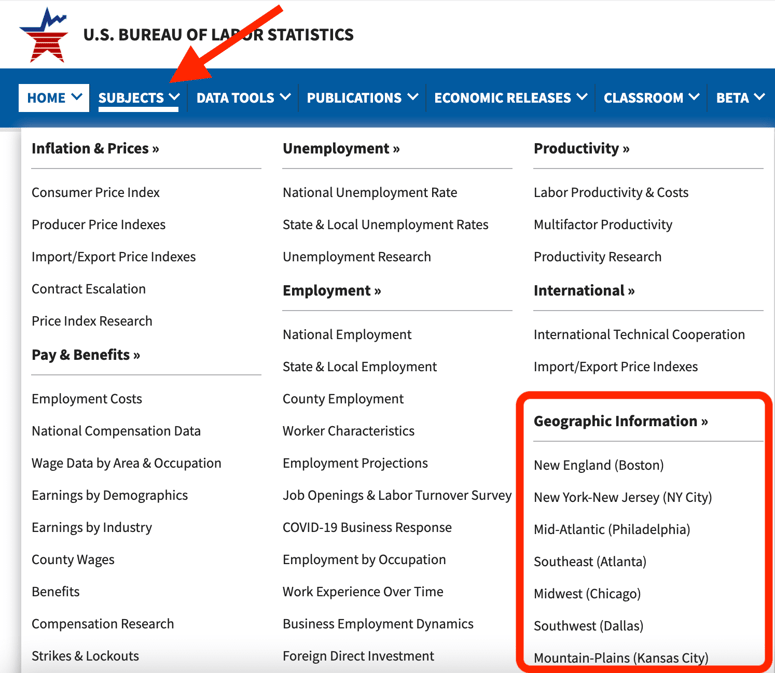

5. Bureau of Labor Statistics

A government organization that “measures labor market activity, working conditions, price changes, and productivity in the U.S. economy to support public and private decision-making,” the Bureau of Labor Statistics (BLS) is a wealth of information.

Because this is a blog post about market research — not an economics class — we’ll focus on BLS’ industry- and region-specific information. If you’re on the homepage and you hover over the Data Tools drop-down menu, you’ll see a hyperlink to something titled “Industry at a Glance.” Click on that, find your industry of interest, and explore the dozens of statistics that BLS has aggregated.

If, for example, you’re interested in the apparel manufacturing industry — either because you’re in the industry or you sell into it — you can see how earnings, prices, and productivity figures are changing over time.

Head back to the homepage, hover over the Subjects drop-down menu, and you’ll see a section labeled Geographic Information:

Select your region of interest, filter by state or metropolitan area (if necessary), and take a tour of BLS’ enormous library of area-specific data.

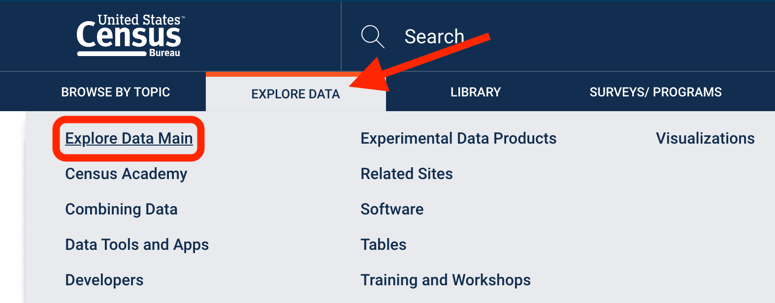

6. U.S. Census Bureau

On a mission to “serve as the [United States’] leading provider of quality data about its people and economy,” the U.S. Census Bureau is another terrific resource that costs nothing to use.

Just as we did with the BLS, we’ll focus on industry- and region-specific information. Admittedly, using the Census website to find industry-specific information is slightly more complicated than it is when using the BLS website. If you’re on the homepage and you hover over the Explore Data drop-down menu, you’ll see a hyperlink titled “Explore Data Main.”

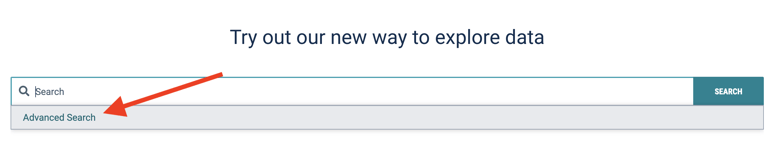

Click on that, and you’ll be brought to the Census’ search engine. Then, click inside the search bar and select “Advanced Search.”

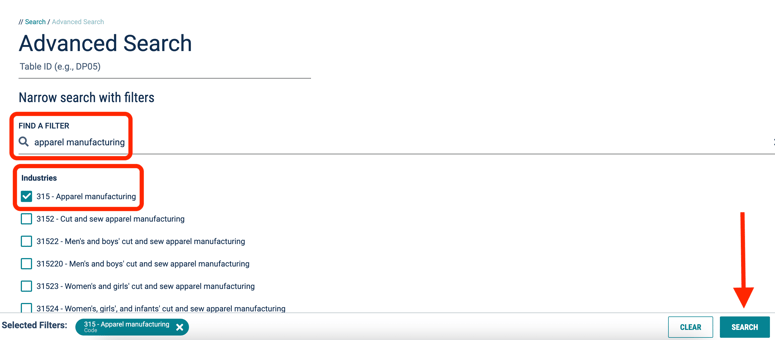

Underneath “Find A Filter,” type in the name of the industry you’re interested in researching. Once the search suggestions load, simply check the appropriate box and click “Search.”

From there, you’ll be able to explore thousands of data tables, maps, and whitepapers — many of them chock-full of industry-specific information that you can use to your advantage.

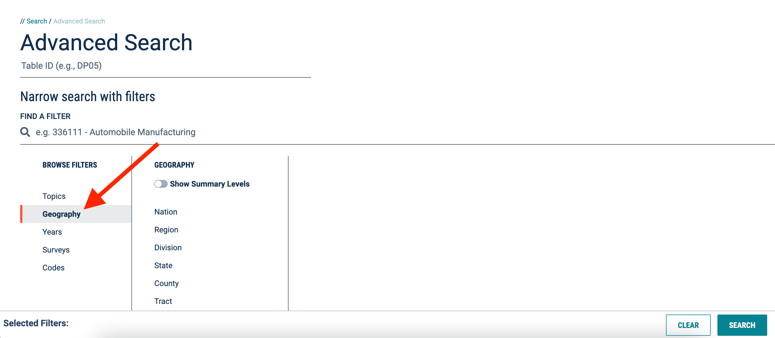

Finding region-specific information is a bit more straightforward. Head back to the Advanced Search engine, select “Geography” from underneath Browse Filters, and go from there:

7. Pew Research Center

A nonprofit dedicated to “inform[ing] the public about the issues, attitudes, and trends shaping the world,” the Pew Research Center is one of the most authoritative sources of information for anyone striving to make better business decisions.

Whereas the BLS and the Census are (among other things) aggregators of economic data, the Pew Research Center is a “fact tank” — an organization focused on public opinion polling, demographic research, media content analysis, and other forms of social science inquiry.

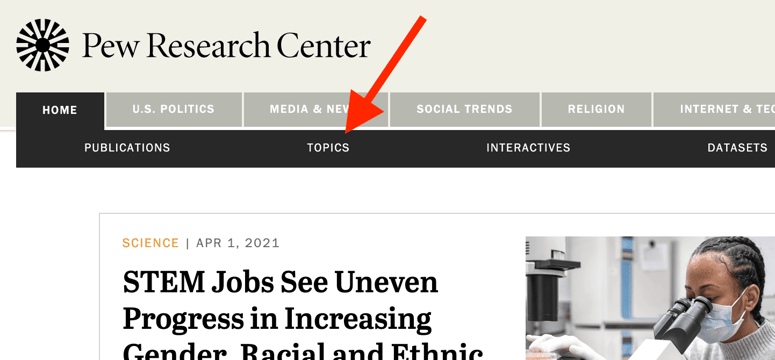

So, although you can’t necessarily use Pew to uncover hyper-specific insights related to your industry or region, you can use it to learn more about your target audience. The best way to do this is through the Topics section of the Pew website.

Clicking that hyperlink brings you to an index of dozens of topics, ranging from Online Video to Homeownership to Democracy. Selecting any of these topics will bring you to a list of relevant content — reports, fact tanks, transcripts, and other forms of media that can date back as far as the early 1980s.

As an example, let’s say you’re developing a product or service that targets new homeowners. If you were to click on the Homeownership topic, you’d land on a list of reports like this one:

If I were you, that’s not a report I’d want to overlook!

8. G2

We’ll wrap up today’s guide with a free resource specifically for those of you in the software world. Designed to help buyers determine which products are best suited to their needs, G2 is the leading source of validated, unbiased software reviews.

G2 is, in other words, an excellent way to find out what your target customers are saying about your competitors’ products. Do a quick search for the type of software you’re developing and you’re in business.

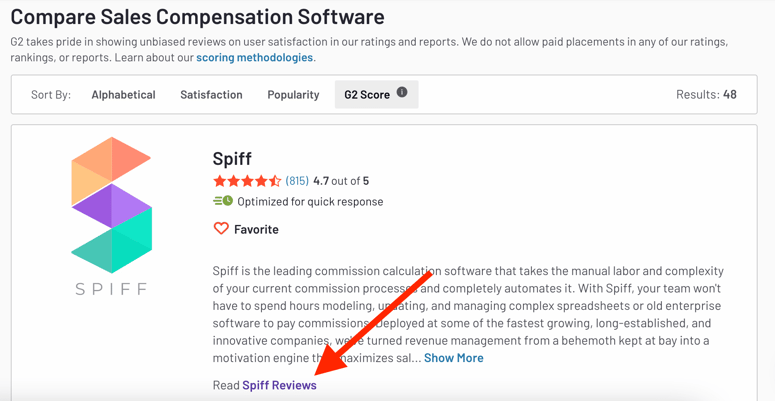

If you were developing a sales compensation software product and you searched this keyword, you’d be brought to the page you see below. To learn more about Spiff — one of your top-rated industry competitors — all you’d need to do is click “Read Spiff Reviews.”

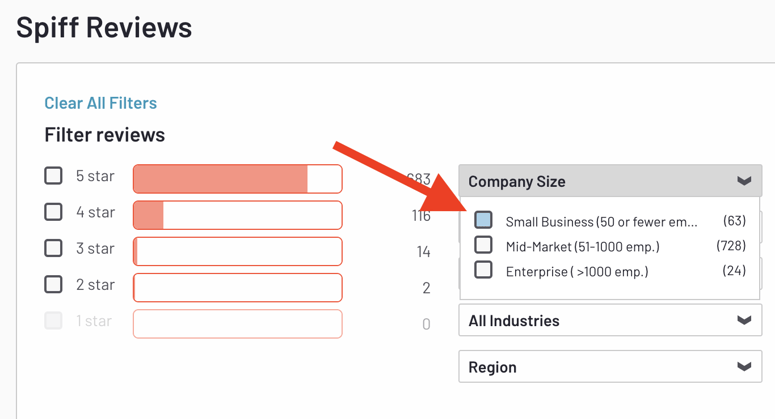

If you want to get granular, you can filter reviews in a number of different ways. As an example, let’s say you’re developing a sales compensation software product specifically for small businesses. G2 has the filter you’re looking for:

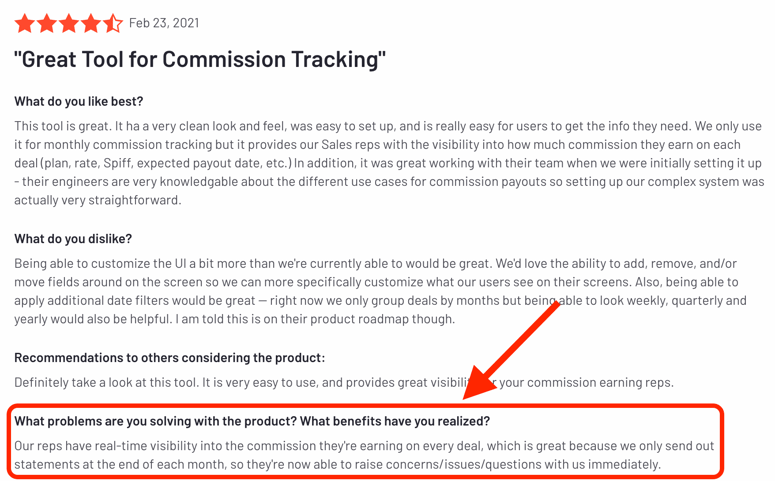

And just like that, you’ve got access to dozens of valuable insights like this one:

Start using market research tools today!

If you try to bring a product or service to market without an understanding of your target customers, your chances of success are slim. According to the most recent State of Competitive Intelligence Report, 84% of businesses say their industry has gotten more competitive in the last three years. With the range of choices at your prospects’ fingertips growing by the day, the need for a thorough market research strategy only intensifies.

We hope you find these free market research tools and resources useful. And if you decide to make the leap to a paid solution, make sure to request a demo of Crayon — the competitive intelligence platform that enables you to track, analyze, and act on everything happening outside your businesses’ four walls.