It’s good to be the king.

Companies that ascend to the top of their industries and become category leaders have one goal: continue to grab market share while fending off the ankle-biters that seek to displace them from their thrones. Fortunately for these category leaders, playing defense has historically been much easier than playing offense.

The shifting ways in which companies execute across each business function is changing that notion. Nimble startups are transforming into category leaders seemingly overnight. The proliferation of scalable technologies has democratized many business functions, and one of the stalwart weapons in the defensive arsenal of the Fortune 500, competitive intelligence (CI), is the next to fall.

The Incumbency Advantage

Incumbency advantage is a well-documented phenomenon in the arenas of business and politics. Companies sitting at the top of their markets enjoy a number of advantages that help them stay at the top. Stronger brand recognition helps, as do the operational efficiencies that come with industry experience and economies of scale. An advantage that cannot be understated is the resource superiority category leaders wield. Faster product development, a larger salesforce, wider marketing campaign coverage - resource superiority benefits nearly every function.

Get your free copy of the Guide to Competitive Intelligence >>Nowhere is this phenomenon more pronounced than in competitive intelligence. For decades, corporations at the top of their categories have assembled well-funded teams of competitive intelligence professionals. Many also partner with consultancies specializing in competitive intelligence. The outputs of these teams have guided everything from long-term market strategy all the way down to the execution of individual sales opportunities. Over 90% of Fortune 500 companies have a competitive intelligence program in place for this very reason.

Smaller companies, on the other hand, rarely invest in competitive intelligence in a meaningful way. Maintaining a CI team is expensive. When budgets are tight, resources typically go to functions that executive leadership can more directly tie to revenue growth, like sales or product development. More common in smaller companies is for CI to be a minor function carried out by someone in product marketing or a related discipline. These individuals are often responsible for a wide variety of functions, and competitive intelligence is far from the top of their lists.

The Democratization of Business Functions

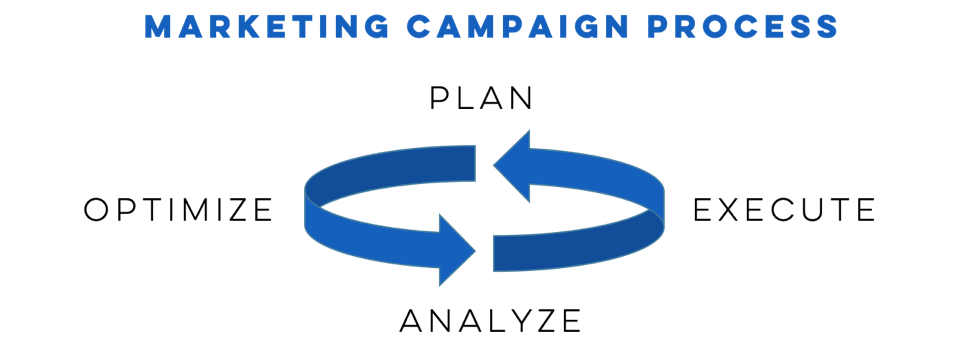

In recent years, the resource disparity between category leaders and everyone else has been rendered less meaningful. The emergence of cloud-based software has democratized many business functions. Now, even small startups can leverage everything from marketing automation platforms to ERPs. These technologies do not fully automate any business function. Rather, they zero in on the aspect of any function that requires a high degree of time-consuming labor. Let’s look at marketing automation platforms and their involvement in the marketing campaign process as an example.

Campaign planning, analysis, and optimization can only be performed by a marketer who understands how these actions impact business-level KPIs. The actual execution of campaigns, however, is a tedious process that is now largely automated by software. This leaves marketers time to focus on the three more valuable functions that software can facilitate but never automate. This is how software narrows the output differential between a two-person marketing team and a twenty-person team.

Late to the Party

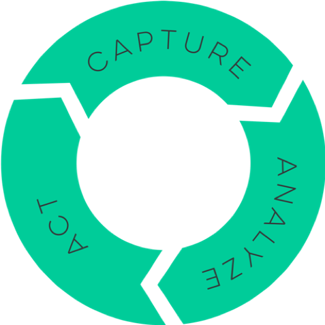

Why has competitive intelligence been isolated from this democratization? The traditional CI process has no real opportunities for automation. CI can be broken down into three basic steps: capture intel, analyze that intel to glean valuable insights, and distribute those insights to the teams that can act on them. None of those steps previously offered any meaningful opportunities for software-driven automation. As advanced as technology has become, it will likely never be able to covertly mine intel from trade shows or product demos. This is why competitive intelligence gathering has always been entirely manual.

The sheer volume of information now available on the internet is flipping that notion on its head. Competitors’ websites, forums, review sites, social media, hiring pages - the internet contains a treasure trove of competitive signals. The new challenge in this landscape is that every valuable competitive insight is buried in ten times as much worthless noise. Capturing and processing intel from digital sources is much more tedious, and as such, a much better candidate for a software-driven approach.

The King is Dead

None of this is to say that the traditional processes for capturing intel are null. Much like marketing automation platforms and marketing teams, CI software alone does not constitute a CI program. The analysis and distribution of insights will always require a team that understands the impact of CI on business outputs.

However, the step in the CI process that software is now able to streamline at a comparatively low cost has shifted the balance of power between small companies and category leaders. According to CI professionals, capturing intel is the most time-consuming part of the CI process. By automating a large portion of the most time-consuming step in the CI process, software has diminished the power of a category leader’s resource superiority in another key business function.

What does this mean for category leaders and the aspiring regicides looking to displace them? The opportunity for smaller businesses is clear. With the aid of CI software, the individual or small team responsible for CI can augment their CI program at a relatively low cost. A product marketer performing CI for a few hours a week can now derive much more meaningful outputs from those few hours.

Long Live the King

The threat category leaders face is unambiguous but not unavoidable. The traditional means of gathering intel are still valuable and not accessible by most small companies. The gathering of intel is also far from the most important part of the CI process. In their research for the Harvard Business Review, Benjamin Gilad and Leonard Fuld found that many corporate CI programs focus entirely too much on gathering intel and only half of it ends up being used. Crayon’s own research found that CI programs are most successful when the intel gathered is consistently distributed to as many internal stakeholders as possible. With the gathering of intel becoming much more accessible for smaller companies, category leaders should focus their resources on deep analysis and wide distribution of insights to maintain their edge.

Much like marketing automation platforms or ERPs, competitive intelligence technologies are changing the way CI is performed. Startups that adopt competitive intelligence in a meaningful way will find themselves better able to compete with larger corporations. Category leaders who adopt CI technologies and continue to apply their resource superiority to the other aspects of CI will find themselves able to weather the storm. Those who don’t may find themselves in an “adapt or die” scenario.

Seeing is believing! Check out Crayon for yourself.

Take a Product TourRelated Blog Posts

Popular Posts

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

24 Questions to Consider for Your Next SWOT Analysis

24 Questions to Consider for Your Next SWOT Analysis

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking