Back-to-school season is always an exciting time of year. Classmates come together to trade tales of summertime adventure (and, eventually, employment). Teachers brainstorm new ways to engage and empower their students. Parents wonder how their kids are getting so old.

For the second consecutive year, however, COVID-19 is supplementing—and, for some folks, replacing—the usual excitement with feelings of uncertainty and stress. Meanwhile, the ongoing pursuit of social and racial justice has sparked debate around curricula and, more broadly, the relationship between school systems and students’ worldviews.

Suffice to say that marketing teams in the education industry have quite a bit to keep in mind as they strive to position and promote their solutions, differentiate their brands, and create unique experiences for their prospects.

To aid these teams in the planning and execution of their initiatives, the Crayon team has published a brand new report: Who Led the Conversation In the Education Industry This Summer? In a nutshell, we used data captured by our competitive intelligence software platform to analyze recent marketing activity across 10 leading brands:

- Amplify Education

- Dreambox Learning

- Great Minds

- Houghton Mifflin Harcourt

- Imagine Learning

- Istation

- McGraw Hill

- NWEA

- Renaissance Learning

- Scholastic

We uncovered a lot of neat insights, and one in particular threw us for a loop: COVID was frequently mentioned in these brands’ blog posts throughout the summer—but it was largely absent from their social media posts.

Let us show you what we mean.

Download our full report on the education industry >>

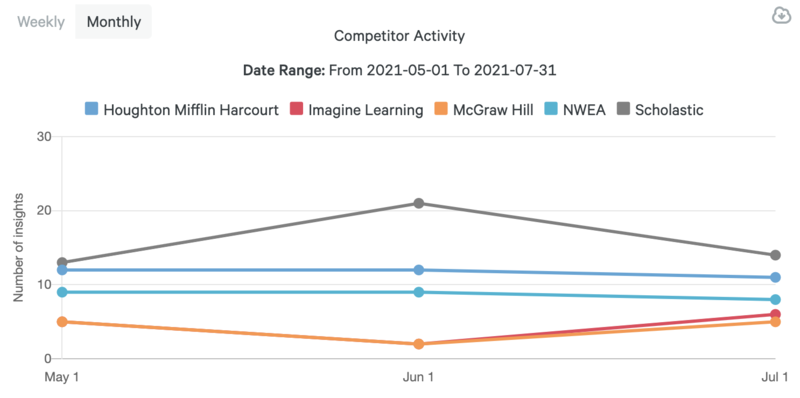

Content marketing in the education industry

Blogging is the dominant form of content marketing in the education industry. Of the 317 content pieces we captured between May 1, 2021 and July 31, 2021, 159 were blog posts—and that’s not counting the 64 Medium articles published by McGraw Hill.

Scholastic led the pack by a fairly wide margin, publishing 48 new posts on their blog. They were followed by HMH (35), NWEA (26), Imagine (13), and McGraw Hill (12).

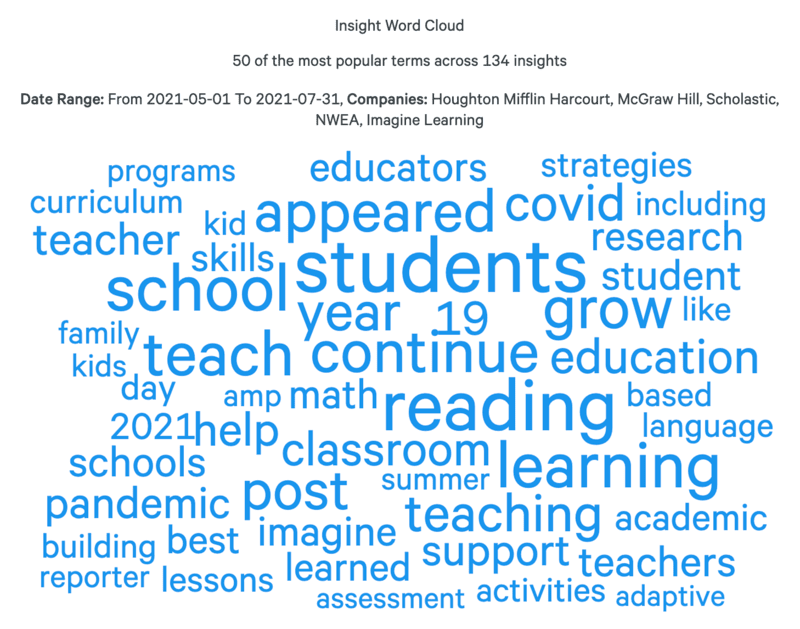

So, in total, these 5 brands published 134 blog posts over the course of May, June, and July. Using the word cloud functionality that’s built into Crayon, we were able to generate a visual representation of the 50 words used most frequently across these blog posts. The bigger the word, the more frequently it was used:

As you can see, both “covid” and “pandemic” appear in the word cloud—and although they’re not amongst the biggest words, they’re not amongst the smallest either. Clearly, the ongoing public health crisis made its fair share of appearances in the summertime blog posts published by education brands.

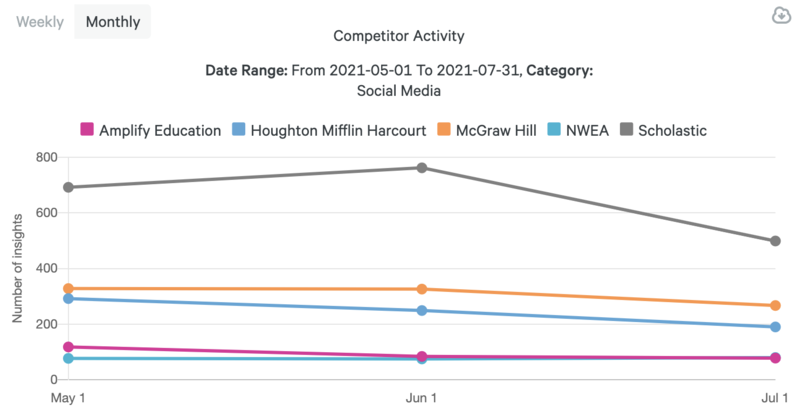

Social media marketing in the education industry

Twitter is the dominant social media platform in the education industry. Of the 5,006 social posts we captured between May 1 and July 31, 3,312 were tweets.

Scholastic was once again the leader of the pack, publishing a whopping 1,250 tweets. They were followed by McGraw Hill (680), HMH (531), Amplify (203), and Great Minds (164).

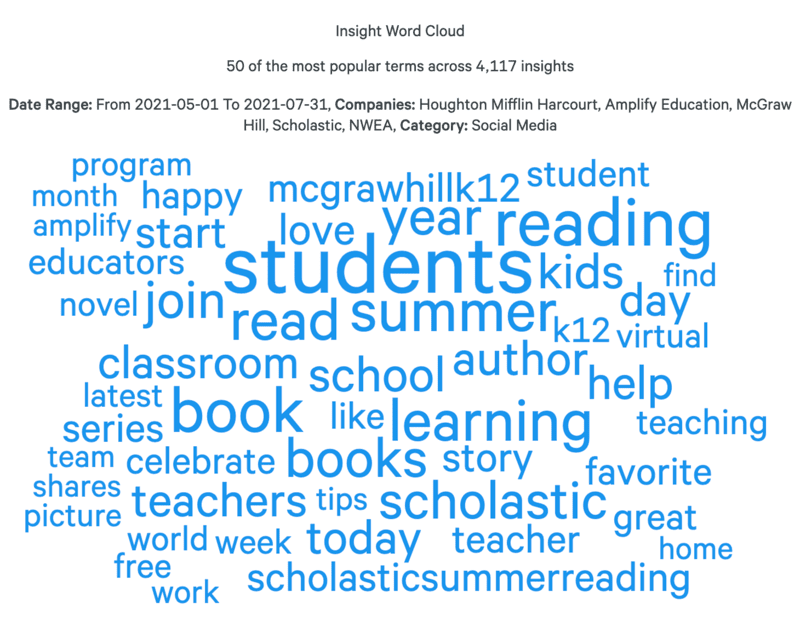

So, in total, these 5 brands published a total of 2,828 tweets this summer. When we generated the corresponding word cloud, we expected to see something closely resembling the one you see above—and we were wrong:

As you can see, neither “covid” nor “pandemic” is anywhere to be found. “Virtual” clearly refers to the remote learning environment made necessary by COVID, but that’s as close as we get to a mention of the pandemic that was so frequently and explicitly discussed in summertime blog posts.

And I know what you’re thinking: Scholastic published twice as many tweets as the next-closest company—which means the word cloud must be misleading. For whatever reason, Scholastic kept their Twitter profile COVID-free, and as a result, they skewed the representation of the industry as a whole. Right?

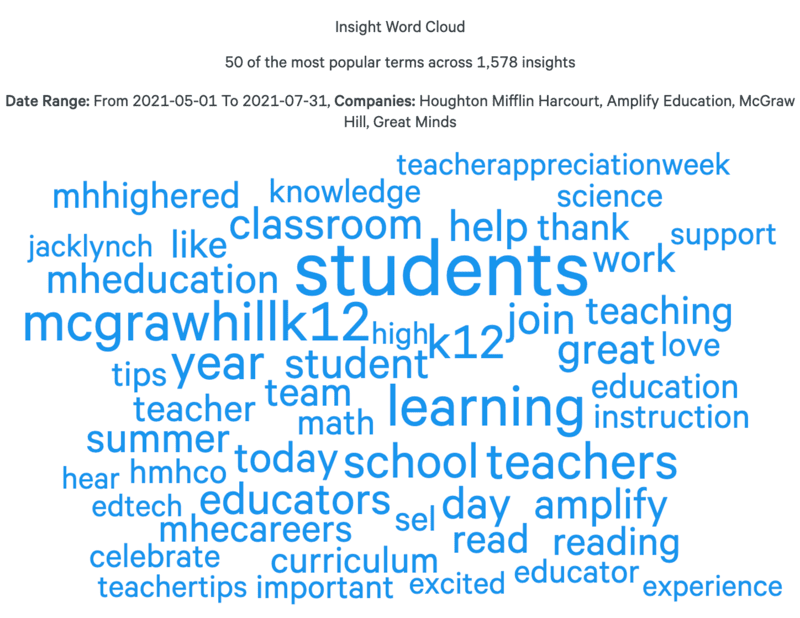

Nope. Look what happens when we take Scholastic out of the equation:

Clearly, education brands took two very different approaches to their blogs and their social profiles this summer. This leads us to an important question:

So what?

Turning intel into action

Competitive intelligence (CI) is a three-step process:

- Track (gathering information)

- Analyze (connecting the dots)

- Activate (taking action)

Obviously, each step is critically important. But it’s in that third step where the money is made—literally. According to our State of Competitive Intelligence Report, 72% of businesses that activate intel on a weekly basis have seen positive revenue impact as a result of their CI investment. Compare that to 55% of businesses that activate intel on a monthly basis, and 46% of those that activate intel on a quarterly basis.

Evidently, it’s important to take action—and to take action often. Through our analysis of education brands, we’ve uncovered that they’re far less inclined to talk about COVID on social media than they are on their blogs.

If you were a marketer at one of these companies, how might you turn this intel into action?

Here’s one idea: Share more COVID-related content on your social channels—always keeping in mind the most up-to-date science, of course—and see how it’s received by your audience in comparison to everything else your company posts. At the same time, on those somewhat rare occasions when your competitors share COVID-related content, pay close attention to how it’s received by their audiences. The goal here is to determine whether there’s an appetite amongst followers of education brands for content related to the pandemic and its impact on schools. If you find that there is, in fact, an appetite for this content, then you have an opportunity to fill a glaring gap in the market—an opportunity to address a demand that your competitors do not.

Now, this is just one single idea in response to one single insight. The more important point is this: Even when school is out for the summer, change is a constant in the education industry. New content is published, new campaigns are launched, and new priorities are pursued.

To get fully up to speed, click on the banner you see below and download our complete report.