We touched on it in our guide to penetration pricing, and today we go deep on one of the most polarizing pricing strategies out there: loss leader.

In this post, we’ll define loss leader pricing, explain why it gets a bad rap, and share three real-world examples of companies employing this controversial competitive pricing tactic.

What is loss leader pricing?

Loss leader pricing is a strategy predicated on selling a product at a loss in hopes of attracting customers who can be upsold and cross-sold products with healthier margins.

Ultimately, loss leader pricing can be an effective way to:

- Introduce a new product

- Foster brand loyalty

- Move stale inventory

Imagine …

Ten customers come to your website, SHOETOPIA, via the ad they saw promoting BASICALLY FREE SHOELACES. Eight of those fine bargain hunters throw shoelaces into their shopping cart; four of those eight also buy a pair of sneakers.

Let’s break it down.

Customers visited your website intent on purchasing the loss leaders (shoelaces). While some were steadfast in their thriftiness, others purchased big-ticket items (sneakers) that they wouldn’t have purchased without having first taken advantage of that incredible deal.

In the short term, you took a haircut on a few orders but came out on top in the aggregate. In the long run, you’ve added valuable customers to your CRM.

Not bad.

Now for the not-so-neat parts.

Download the Ultimate Guide to Competitive Pricing >>

The risks of loss leader pricing

A loss leader strategy isn’t always roses, and it isn’t for everyone.

Here are the three biggest hurdles to making loss leader pricing work for your business.

Losing revenue

Inevitably, some folks will purchase a loss leader (shoelaces) without also buying complimentary products (sneakers)—and then do it again ... and again ... and again.

It’s savvy shopping made easier in an age where everything is purchased online. And it’s one of the biggest reasons to not deploy a loss leader pricing strategy.

You might lose more money than your business can tolerate; you may also run out of inventory, which reflects poorly on your business and robs high-value customers—the people you intended to attract with the loss-leader in the first place—from taking advantage of your offer.

Losing relationships

Customers represent one side of the loss leader equation; manufacturers are the other.

If 100 other websites sell the same product as you, but you’re undercutting the rest of them for the purposes of attracting customers, guess where those customers aren’t buying those same products?

This can potentially negatively affect brand perception and supply chain for the manufacturer. As a product becomes associated with a deeply-discounted price point, it loses its luster. You, the website owner, don’t really mind this, since the goal is to cross-sell premium products. But that manufacturer doesn’t see any of that lift. They become “the cheap shoelace company.” Not everyone would be stoked on that moniker.

Breaking the law

Last, but certainly not least, we come to the question of legality.

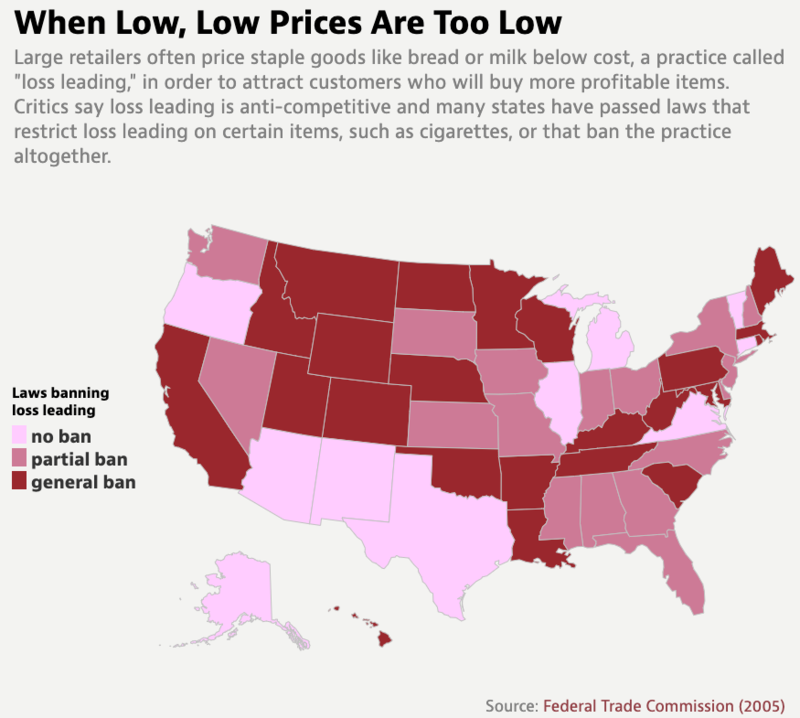

Loss leader pricing is totally or partially banned in some states because it’s anticompetitive. What does that mean? It favors large retailers and can have a negative impact on small businesses.

Via the American Economic Association.

Big-box retailers can afford to take a loss on product X in the hopes of selling more product Y and Z. Mom and pop shops can’t. As such, many states (and countries for that matter) have taken action against loss leader pricing, particularly in instances where a product is sold for less than its manufacturing cost.

If you’re thinking about deploying a loss-leader strategy, do your research first!

Loss leader pricing in action: 3 real-world examples

eBooks and eReaders. High-priced razor blades and shockingly affordable handles. Literally anything at Costco. What do these things have in common?

Synergy.

Ultimately, loss leader pricing is most effective when it occurs naturally. Printers are crazy cheap, but do you know isn’t? Ink.

And guess what? You can’t print much without ink.

When the money is in the consumable (the ink, the razor blade, the ebook, etc.), taking a significant loss on the first sale is infinitely more palatable.

Here are three examples of loss-leader pricing that. just. work.

eReaders

Over the years, Amazon has implemented loss leader pricing deftly in an effort to absorb, well, everything. They’ve used Prime/shipping as a loss leader to fundamentally change consumer expectations for delivery speed.

But today, we’re talking Kindle. You can buy one for less than $100. Crazy, right?

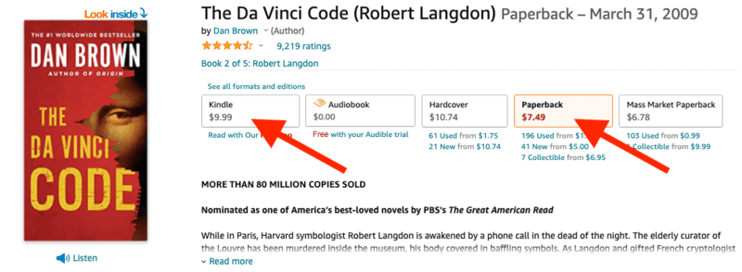

Not when you consider the fact that, in many cases, digital copies of books sold on Amazon are more expensive than their paperback counterparts:

By pricing the Kindle device low, Amazon draws readers into their ecosystem, where they are likely to continue purchasing digital copies of the latest NYT bestseller. Suddenly, that loss leading eReader is looking like a pretty great investment.

The DTC razor

What started with silly commercials (shout-out Dollar Shave Club) has morphed into a crowded industry in which loss leader pricing is table stakes.

Think about it.

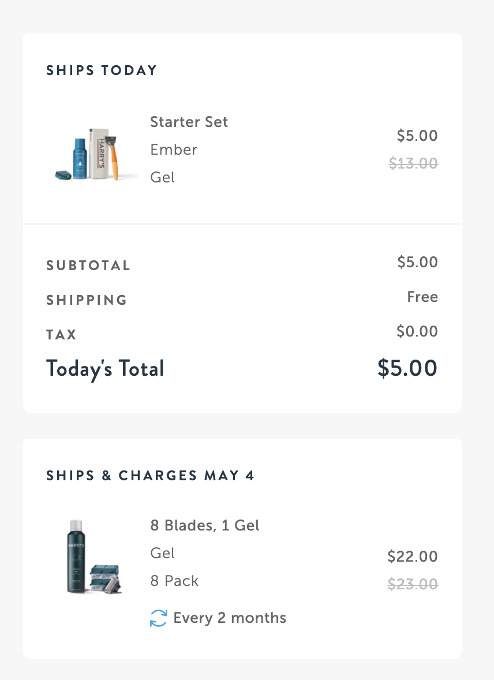

The Harry’s starter set comes with a handle, foaming shave gel, travel blade cover, and a razor cartridge. It costs a mere $5 AND it ships for free. Textbook loss leader.

Now, pay close attention to that recurring payment.

Razor cartridges must be replenished, and Harry’s has given you the opportunity to avoid ever being caught without a fresh blade by subscribing at checkout. Spend $5 today, spend another $22 every eight weeks. Dependable, recurring revenue elicited through a loss leader.

The thing that makes pairing a loss leader offer with a subscription particularly genius is that it all but eliminates the risk of losing revenue.

Now, there’s some fun math that needs to happen for a strategy like this to make long-term sense. You need to calculate the point at which you break even on a given customer (in other words, how many months must a customer remain subscribed before your CAC is paid in full), then focus energy on keeping them around in order to drive profitability.

Food courts

What do Costco and Ikea have in common?

They win your heart with hot dogs.

Come for the cased meats, leave with a 40 pack of toilet paper or a bookshelf that’ll cost more sanity than cents to assemble.

For many, going to Costco is something of a pilgrimage.

You show up prepared to face throngs of shoppers who’ve come from miles away—you need sustenance. $1.50 for a hot dog and a 20oz soda is a deal that cannot be beat. Adequately fueled, you’re ready to shop. You’ve got the stamina to traverse the entire store, adding to your shopping cart along the way.

Loss leader pricing: The bottom line

If you sell a consumable product, loss leader pricing can help drive customer acquisition and recurring revenue. If you’re a small business trying to compete with multinational behemoths, it’s probably worth steering clear, instead choosing to win through superior service.

TL;DR: Make sure you understand how loss leader pricing will impact your business—and whether there are legal restrictions—before implementation.

Seeing is believing! Check out Crayon for yourself.

Take a Product TourRelated Blog Posts

Popular Posts

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

24 Questions to Consider for Your Next SWOT Analysis

24 Questions to Consider for Your Next SWOT Analysis

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking