Formulating messaging that resonates with your target market is a challenging endeavor. Strong messaging needs to concisely demonstrate differentiated value that addresses the unique goals and challenges of your buyers. To achieve this, many marketers understandably employ a customer-centric approach to messaging. Fully understanding your customers’ challenges, goals, and general buying behavior, is unquestionably important in crafting effective marketing messages.

Another popular approach to creating effective messaging is analyzing your competitive position in the market and the messaging of your competition. Even if you know what motivates your target buyer, it’s important to understand that most buyers have a myriad of solutions available to them that can address their challenges/goals. Many marketers believe that these two approaches to messaging are mutually exclusive. I’ve witnessed endless discussions at conferences, on LinkedIn, and seemingly everywhere else about which is more important: being customer-centric or competitor-centric.

This type of black-and-white thinking is detrimental to the formulation of great messaging. The best messaging is both empathetic to the needs of your customers and conscious of the alternatives available to them in the market. This kind of customer-centric, competitor-conscious approach is, contrary to popular belief, entirely possible to employ. There are a few straightforward steps to take to ensure you create and maintain a customer-competitor balance.

The Customer is Always Right

Making assumptions about what motivates your buyers is a dangerous game. It’s important to learn directly from customers/buyers what challenges and goals your messaging should speak to. There are several ways to tap into this information:

Ready to get started? Download your free competitive analysis template

Customer Interviews: Work with your account managers to arrange interviews with as many customers as possible. Try to learn about their roles, how they’re measured, their challenges, their goals, and how all of that fits into their company’s higher level goals.

Customer NPS Surveys: Net Promoter Score (NPS) surveys or other similar studies are great ways to understand customer satisfaction with your product. They can also be a great way to get a deeper understanding of their higher level goals, what they’re looking for in a solution, etc. While you won’t get as much context/detail as individual customer interviews, surveys will allow you to reach a much larger sample size of customers.

External Buyer Research: Your existing customer base is a great source of information, but it’s inherently biased towards those who have already chosen your product. To get the full picture, make sure to glean information from non-customers who fit your target demographic. External market research through third-party firms can provide valuable information. Analyst inquiries with companies like Forrester or Gartner are also valuable (albeit expensive) sources of information. Even doing your own personal outreach to interview non-customers can be effective in rounding out your research.

Wherever you elect to gather information on your buyer personas/customers, make sure you’re getting the full picture. Ensure you get representation from a wide variety of seniority levels, company sizes, and industries.

Know your Enemy

No product exists in a vacuum. When crafting messaging meant to address your buyers’ needs, remember to be cognizant of the many competitor messages also addressing those needs your buyers receive every day. Your customer-centric messages need to stand out amongst other customer-centric messages. The first step in differentiating is to analyze your competitors’ messaging at varying levels of depth.

Fortunately, you have about as much access to the messaging deployed by your competitors as your customers do. Here are several key sources of competitor messaging to analyze:

Homepage: Here you’ll find your competitors’ messaging in its most concise form. Page titles and alt text employed here also provide a window into keywords and industry phrases your competitors are targeting.

Product Pages: These pages are where competitors will take a deeper dive into their offerings. More importantly, these demonstrate how they translate specific products/features to address their perception of the goals and challenges of their customers.

Presentations: Sales demo decks, company overviews, or even thought leadership content published by marketing teams can provide additional messaging input for your analysis. Search for company PDFs on Google or check public sites like SlideShare to access these types of presentations.

These are just a few key sources. For more sources of competitor messaging and a framework for analyzing them, read through this post on the topic.

When undergoing a competitor messaging analysis, make sure you’re maintaining a customer-centric mindset. Don’t think of this as a feature tit-for-tat. Rather, focus on how your competitors are addressing the customer needs you uncovered.

All Together Now

You have a solid grasp of your target buyers’ goals/challenges. You’ve assessed how your competitors are addressing them. Now, you can begin to craft customer-centric, competitor-conscious messaging. This is straightforward conceptually but difficult in execution. To contextualize how this is done, we’ll walk through a tangible example: how Salesforce provides differentiated, customer-centric messaging in a crowded CRM market.

In Forrester’s Q4 2018 CRM Suites Wave report, Forrester evaluated CRM solutions based on a wide range of criteria most important to buyers. The two front-runners were Salesforce and Oracle. Both received strong scores across nearly every single criteria. One could posit that they both address the high-level goal buyers have when purchasing a CRM (maintaining strong customer relationships) in a similar fashion. And yet, the messaging each company has deployed on their websites is distinct.

The image below is from Salesforce’s product pages.

In just a few bullet points, Salesforce cements their ability to support growing businesses by zeroing in on what that specific customer demographic cares about: scalability, support, and a straightforward app ecosystem. Such statements are more difficult to find on Oracle’s product pages, which speak mostly to Oracle’s broader, deeper capabilities and robust integrations with other enterprise solutions.

Both companies address the goals of their customers but are also highly conscious of the fact that messaging claiming to solve the customer relationship management challenge isn’t enough. Both companies do so in an entirely distinct fashion, speaking to specific customer needs in differentiated manners.

Keep it Fresh

Just a year later, Forrester published another Forrester Wave report, Digital Experience Platforms, Q3 2019. Once again, Salesforce and Oracle were pitted against each other and received remarkably similar scores. However, in that time, two critical things changed: the buyer criteria used to evaluate both companies, and the functionality/offerings of both companies. This highlights the danger of letting your messaging remain stagnant.

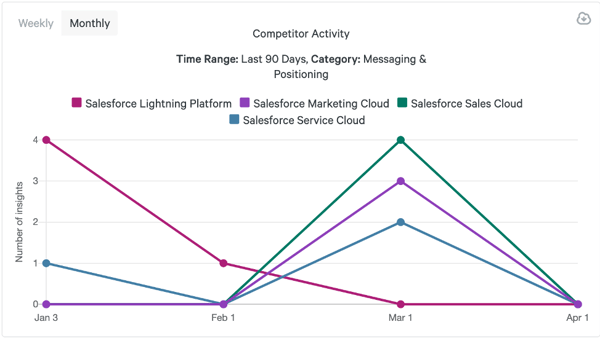

According to Crayon’s data, Salesforce has made 15 changes to messaging on their website just in the last 90 days. Oracle has made 34 changes to their website messaging in as much time. To keep messaging effective, your understanding of your customers’ needs and competitors’ positioning should be refreshed as often as possible. Customer research should happen at least annually, if not quarterly. Competitive intelligence should be an ongoing process. Establishing and maintaining a customer-centric, competitor-conscious mindset will keep your entire go-to-market function as sharp as possible.

Seeing is believing! Check out Crayon for yourself.

Take a Product TourRelated Blog Posts

Popular Posts

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

24 Questions to Consider for Your Next SWOT Analysis

24 Questions to Consider for Your Next SWOT Analysis

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking