Receiving an inbound demo request is often the best part of a salesperson’s day. Learning that the evaluation is going to be competitive in nature can be less exciting. Sales teams in competitive industries frequently learn they’re in for a competitive fight in the midst of a sales cycle. Even worse is learning that information after you’ve already performed a product demo and the sales cycle is winding down. At that point, it can quickly devolve into a race to the bottom on pricing or other contract terms to win.

Competitive sales cycles don’t have to incite dread. Prospects evaluating multiple solutions are frequently much more committed to making a decision one way or another. If approached correctly, competitive sales cycles can have win rates higher than those that lack competition as you aren’t fighting as hard for budget, buy-in, and urgency. There are steps that several different teams can take to boost competitive win rate, and they start well before the demo request occurs.

Demand Generation: Start at the Source

In an ideal world, salespeople know if an incoming demo request is competitive in nature well before they speak with the prospect. Since omniscience isn’t a quality most people possess, gleaning that knowledge before any conversation occurs isn’t easy. Further, prospects aren’t always eager to share when they’re evaluating multiple solutions. They’re even less likely to reveal who those competitors are. Here are three ways in which demand generation teams can help with this.

Get the free Guide to Competitive Comparison Pages to get started!

Identify Competitive Campaigns

The first is to ensure that demo requests originating from competitive campaigns or comparison pages are marked as such when they’re passed to sales. Competitive keyword campaigns running on search engines should point to a unique landing page, flow into a unique campaign in your CRM, or have some other indicator of their competitive origin. Demand gen marketers should provide sales with as much context around the origin of the request as possible.

Secondly, any competitive comparison pages deployed by marketing should receive similar treatment. Such pages almost always contain a demo request or some other sales contact form. Yet in many organizations, demo requests stemming from these pages look the same as any other demo request.

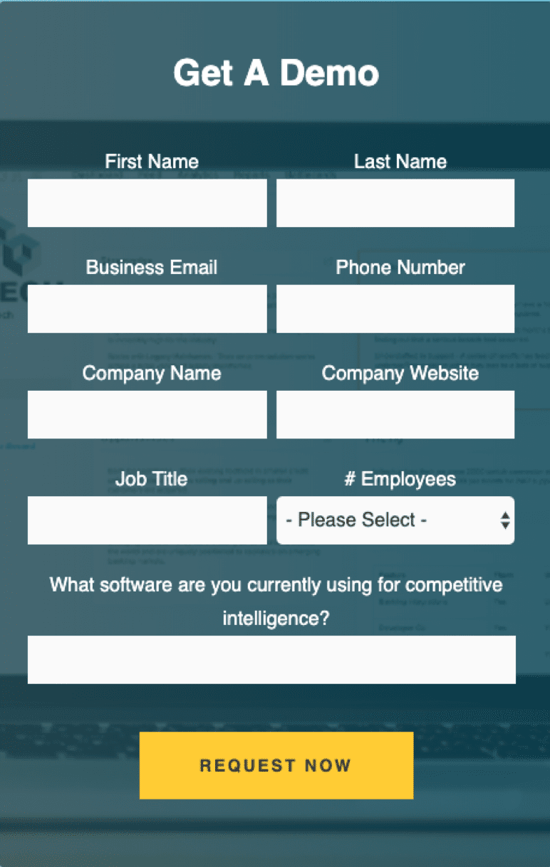

Leverage Form Fields

The last way demand generation can help is by modifying demo request forms to glean competitive information. Asking prospects if they’re evaluating any other solutions helps sales tackle demos in highly competitive industries. If your industry is only moderately competitive, or you’re concerned that such a question may incite a prospect to seek out an alternative solution when they otherwise might not have, asking about existing solutions is a safer option that still provides sales with valuable competitive intel.

Product Marketing: Set Up Sales for Success

The role of product marketing is simple in theory: arm sales with the materials needed to win competitive deals. The execution of this is more complicated than the theory. To arm sales successfully, product marketers should ensure what they’re providing satisfies two criteria. First, that information needs to be easy for a sales rep to consume on the fly. Second, it is critical that the information provided is as up-to-date as possible.

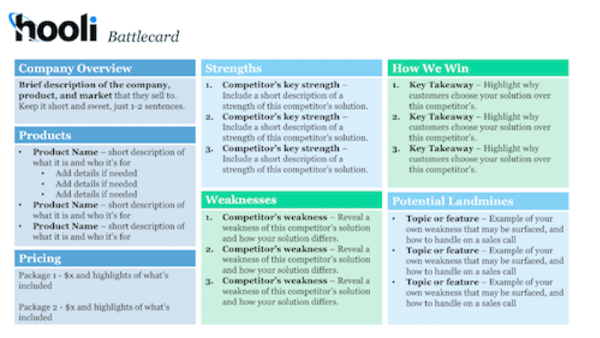

Ease of consumption should be top of mind when product marketers construct competitive analyses for sales. A fourteen-page prospectus detailing every iota of a competitor’s business is not an unhelpful asset. That said, it isn’t a particularly helpful lifeline for a sales rep blindsided by a competitive question halfway through a call. Condensing competitive analyses into battlecards will serve sales much better. Key differentiators and a list of quick soundbites that reps can employ to put competitors into boxes are key. A visually simple layout can also make them a lifeline if a competitor pops up during a conversation.

Keeping the competitive intel that feeds your battlecards up-to-date is an even bigger challenge. Sales teams love battlecards, but the moment they find them to be outdated is the moment they will abandon them altogether. One way to make sure intel stays fresh is to create a collaborative space (like a Google Doc) where salespeople can flag outdated intel. Setting Google alerts is another good way to stay current on competitive activities. Better yet, allow reps to send feedback directly from battlecards and automate the collection of competitive intel beyond news mentions to get the full picture of your competitors’ moves.

Sales: Prepare and Execute

The role of sales in winning competitive demos is straightforward: execute the demo and hopefully move forward to negotiation of terms. The nature of that demo execution, however, depends on whether or not any competitors have yet to be identified in the process. If one or more competitors have been identified by either the demand gen process or by pre-demo sales qualification, extensive preparation is the final step. The key here is to make sure you’re preparing properly.

The internet provides vast amounts of product information to any prospect who looks for it. Prospects are also able to self-educate on product-level differentiators before any demo occurs. Knowing your solution inside and out and how it differs from (and is superior to) the competition is table stakes. Provide real value by focusing on why your solution is the best for that specific prospect rather than just “the best.”

The reason why most industries are fragmented and competition among solutions exists is because one size rarely fits all. Effective battlecards will enable any salesperson to demonstrate the product and industry-level differentiators of their solution. The role of sales is to tie those differentiators to their prospect’s business in a way they know their competition cannot.

When Everything Else Fails

A proactive demand gen team and basic qualifying questions aren’t always enough to sniff out competitors before a demo. Many salespeople take a straightforward approach and directly ask prospective customers if they’re evaluating other solutions.

Unfortunately, some prospects intentionally keep quiet about their evaluations of competitive solutions and won’t answer such a question. If you find that to be the case, employ a bit of subtle sleuthing. Pointed questions from buyers about product features you know your competitors focus on are good indicators of a competitive sales cycle. Competitors may also use specific verbiage when describing certain product/industry ideas to their buyers. If your buyer uses that specific verbiage, there’s a good chance they’ve spoken to that competitor. Sales and product marketing should work together to compile a list of these subtle competitive indicators.

Ultimately, every sales cycle is competitive in nature to some degree. Competitors shape the context of conversations even when your prospects aren’t directly evaluating their solutions. Display ads, industry events, email marketing - buyers are peppered with competitive messages every day. Assume every sales cycle is competitive, and eventually, you’ll find yourself indifferent to the presence of a competitor.

Seeing is believing! Check out Crayon for yourself.

Take a Product TourRelated Blog Posts

Popular Posts

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

24 Questions to Consider for Your Next SWOT Analysis

24 Questions to Consider for Your Next SWOT Analysis

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking